Asia is expected to be the aviation industry’s primary growth driver in the coming years. With a majority of the world’s busiest international and domestic routes now found in the region and passenger demand nearing pre-pandemic levels. That promise new impressive growth figures in 2025, especially when Asian countries are increasingly tourism promoting strategies to attract international tourists

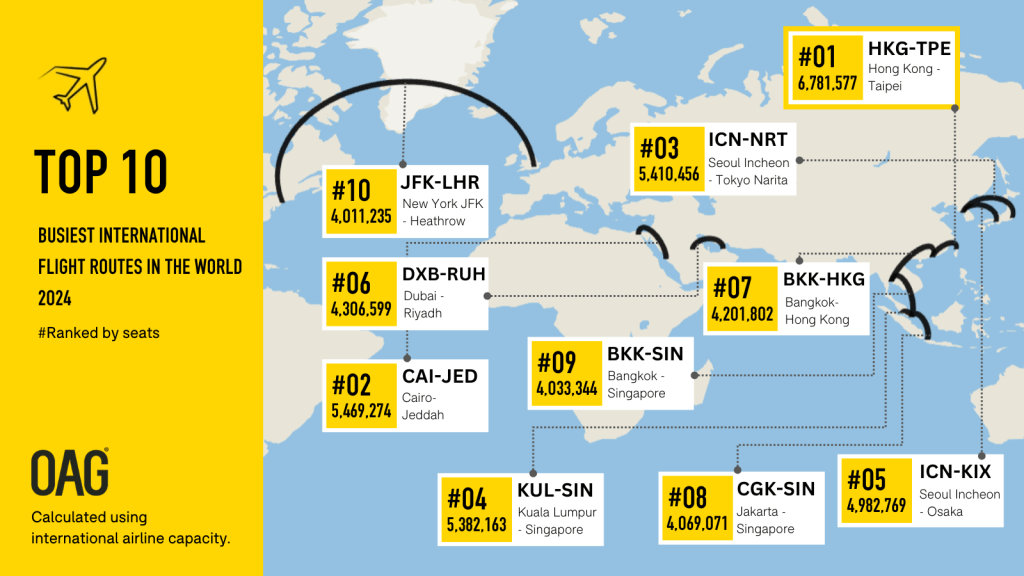

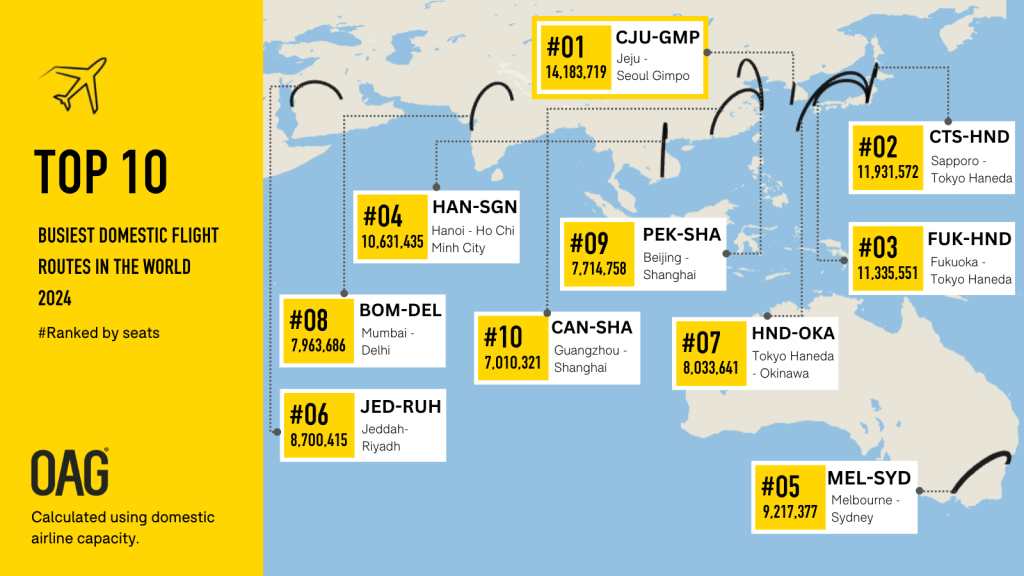

According to ‘Busiest Flight Routes of 2024’ reported by OAG Aviation, seven of Top 10 busiest international air routes were Asian connections, including four of Top 5. Additionally, the region was home to eight of the top ten busiest domestic routes.

Projections from Boeing state South Asia will become the fastest-growing commercial aviation market over the next twenty years. The region could increase its aviation capacity fourfold during the period, and some estimates forecast annual growth to reach eight percent. India remains a catalyst for this as a rising middle class and government support has seen the sector become the third largest globally.

Meanwhile, a number of countries in Southeast Asia are expected to record passenger air traffic growth of more than five percent annually. Thailand, Malaysia, Vietnam, Indonesia, and the Philippines each offer unique opportunities for airlines.

Regarding the Busiest Domestic Routes, eight of the Top 10 were in Asia, including key trunk routes in South Korea, Japan, Vietnam, India and China.

Infrastructure and increasing air links

The development trends of the regional aviation industry come from changes in customer preferences and behaviors, especially increased travel frequency and spending, with more than 80% of travelers planning to take multiple trips in 2025. In addition, the demand for personalized travel experiences will also promote airports and airlines to develop many types of airport and in-flight services such as new technology solutions, luxury shopping services, or sustainability priorities.

Technological innovation is also applied to flight route design. Nowadays, the User Preference Routing (UPR) system is increasingly favored by many airlines such as Qantas and Singapore Airlines. UPR allows pilots to choose the optimal flight path based on real-time weather and air traffic data to increase fuel efficiency and reduce carbon emissions. The sustainable development goal of the aviation industry also comes from the emission burden that the industry is facing.

Many advanced aircraft models such as the Airbus A350-1000 have also been launched. Aircraft models designed for long-haul routes with advantages in improved fuel efficiency or noise reduction design, increasing passenger comfort are currently attracting the attention of many major airlines or airlines with routes in the region.

In order to accommodate the increasing number of air passengers, major airport expansions are underway or recently completed in Seoul (Incheon Phase 4), Taipei (Taoyuan new terminal in 2025)/ Across ASEAN, the start of construction for Terminal 5 at Singapore’s Changi Airport in early 2025, along with the Terminal 3 project at Tan Son Nhat International Airport (Ho Chi Minh City), the Long Thanh International Airport project, the Terminal 3 project at Taoyuan International Airport (Taiwan), and the new three-runway system at Hong Kong International Airport, all demonstrate that infrastructure development is a key strategy for the regional aviation industry in 2025.

ASEAN actively pursues US air connections.

The Philippine Department of Transportation made increasing air links to the U.S. a component of its upcoming aviation masterplan.

In Thailand, the Tourism Authority of Thailand (TAT) continues to seek out airlines to offer service between America and the Kingdom after the Federal Aviation Administration upgraded the country’s aviation safety rating to Category 1.

Malaysia was upgraded to Category 1 more than a year ago and has similarly sought direct air links to the U.S. Elsewhere, the Vietnamese and Indonesian aviation industries are actively exploring ways to increase global connections and flight frequencies.

Navigating challenges

While there are opportunities for airlines across Asian aviation, it is essential to acknowledge some of the challenges that must be navigated. A significant hurdle is air routes being increasingly disrupted due to uncertain geopolitical situations.

The closing of Russian air space to European and US airlines has negatively affected traffic between Europe and Asia. Similarly, issues in Iran, Iraq, Syria, and Israel have created overflying complications.

Competition from Chinese airlines and a potential uneven playing field are pressing issues. European airlines eliminated routes to mainland China as an inability to fly over Russia meant they needed to operate longer routes, leading to higher costs. European policymakers are looking at potential solutions, but nothing has materialised yet.

In addition to that challenge, a number of airlines are now facing delivery delays on new aircraft from Airbus and Boeing as new Chinese aircraft begin filtering into the fleets of China’s major air carriers. This may place them in a better position to take advantage of opportunities elsewhere in Asia.

Asia market opportunities 2025: Asian aviation rises

There are many opportunities on offer in Asian aviation. According to Asian Insiders Managing Partner Axel Blom, not only does the region have most of the busiest air routes globally, but new airports and increasing demand should lift the sector further. Growth here will be significantly greater than in Europe and the Americas. However, there are challenges, including competition from China and uncertain political situations surrounding air space, which operators must be aware of. Entering Asia or increasing regional connections requires a measured approach. Having a partner with experience assisting airlines flying into the region can make a huge difference.